While the Ford brand is kicking ass and taking names, Lincoln seems to be languishing in the doldrums. But The Blue Oval isn’t even close to giving up on its storied luxury brand. Here are two of the most important developments taking place at Lincoln today.

To successfully sell its vehicles, Ford embarked on a plan to aggressively restructure the Lincoln dealer network. In 2011 alone, Ford has reduced the amount of dealers selling Lincoln vehicles to 325 from about 500 in the top 130 markets — where demand for luxury products has historically been strong. Less dealers means more sales per dealer as well as a higher profit per sale, and eliminating multiple dealers in the same geographic area means two Lincoln stores will no longer have to compete against each other for the same customer. Instead, one Lincoln dealer will be able to focus on competing with local Lexus, BMW, and Mercedes-Benz franchises, among others. But the upside for dealers comes with a consequence: Ford asked the remaining Lincoln stores to upgrade showrooms in order to be competitive with the aforementioned import luxury brands. On average, renovations are estimated to be $2 million per dealership.

Initially, Ford planned to eliminate a third of its 1,200 Lincoln dealers in the United States, or approximately 400 stores — mostly in urban areas. The brand had 700 dealers in rural areas.

The reductions in dealerships comes as Ford increases its focus on Lincoln at the expense of Mercury, which (thankfully) was dropped in the fourth quarter of 2010 when production came to an end. The resources that were being taken up by Mercury have since been diverted to Lincoln, which sold 85,643 vehicles nationwide in 2011, a slight decrease from the 85,828 units sold in 2010. At that volume, Lincoln was outsold by every luxury brand in the country (that matters), with the exception of Volvo, Jaguar and Land Rover.

United States Luxury Vehicle Sales - 2011

| BRAND | 2011 SALES |

|---|---|

| ACURA | 123,299 |

| AUDI | 117,561 |

| BUICK | 177,633 |

| BMW | 247,773 |

| CADILLAC | 152,389 |

| INFINITI | 98,461 |

| JAGUAR | 12,276 |

| LAND ROVER | 38,099 |

| LEXUS | 198,552 |

| LINCOLN | 85,643 |

| MERCEDES-BENZ | 261,573 |

| PORSCHE | 29,023 |

| SAAB | 5,610 |

| VOLVO | 67,240 |

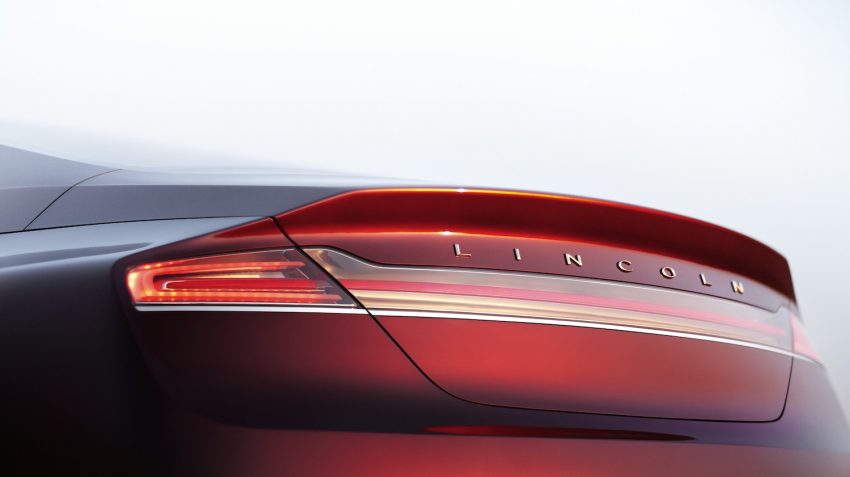

At the heart of Lincoln’s low sales volume is its rather unexciting product lineup, something the brand hopes to address by the middle of the decade. In 2011, The Blue Oval announced a $1 billion revitalization strategy for Lincoln, an effort that should result in seven all-new or significantly upgraded luxury vehicles. The undertaking was previewed at the Detroit Auto Show two weeks ago by the MKZ concept. The brand is also due to receive a small C-segment vehicle to do battle with the likes of the Audi A4, BMW 3 Series, and Lexus IS, among others.

The Motrolix Take

Whether these efforts will be enough to lure away loyal buyers of imported luxury vehicles — and make it worth the $2 million renovation costs for dealers as well as the hefty $1 billion investment by FoMoCo — remains to be seen… but one thing’s for certain: the Ford brand is on fire right now. And we don’t see a reason why The Blue Oval can’t apply some of its One Ford/Go Further magic to Lincoln while creating a global luxury brand in the process. Are we totally off our rocker? Sound off in the comments below.

No Comments yet